The US Dollar (as measured by the DXY Index) recovered early-week losses and posted a gain of +0.51% for the first week of October. The price movement was led by the top three components of the DXY Index, all of which moved marginally in favor of the US Dollar: EUR/USD rates fell by -0.62%, GBP/USD rates fell by -0.57%, and USD/JPY rates increased by +0.45%.

The DXY Index closed higher for the third time in four weeks and the sixth time in the previous eight weeks as a result of the late-week increase in US Treasury rates in response to another excellent US employment report.

In the lack of a Fed rate decision this month, the US economic calendar will be flooded with Fed speakers in the coming days.

The tone of Fed officials' statements, however, might shift substantially depending on the impending US inflation data for September, the most significant event of the week.

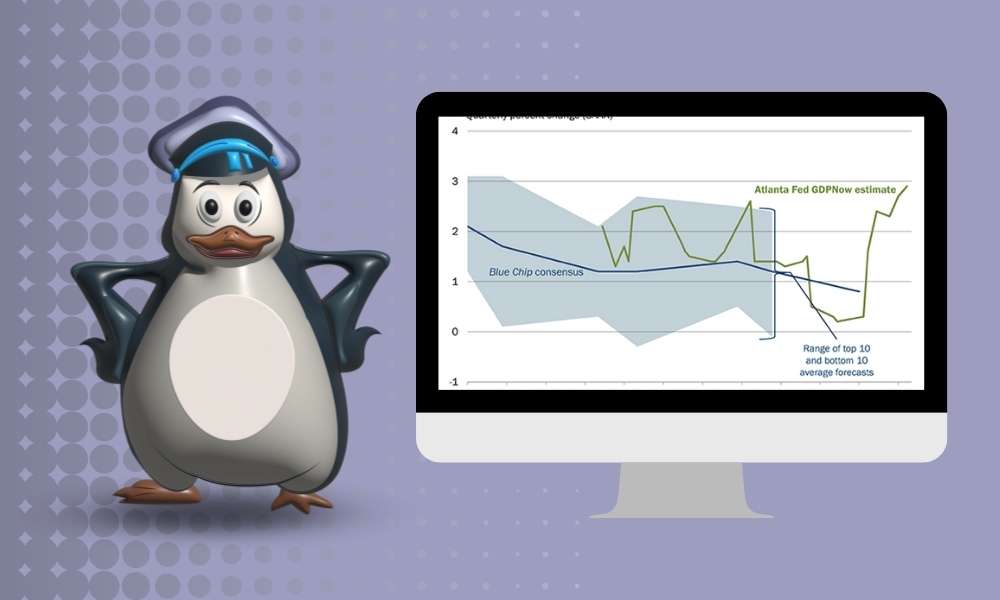

The Atlanta Fed's GDPNow growth prediction for 3Q'22 is now +2.9% annualized, based on the data gathered thus far. "the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth climbed from 1.1% and -3.6% to 1.3% and -3.6%, respectively."

Using Eurodollar contracts, we may determine if a Fed rate rise is priced in by measuring the difference in borrowing rates for commercial banks over a given time horizon in the future.

In order to forecast the direction of interest rates until the end of this year, Chart 1 displays the difference in borrowing costs, or spread, between the front month and January 2023 futures contracts.

Over the past two months, there has been a close correlation between the DXY Index, the shape of the US Treasury yield curve, and the likelihood of a Fed rate rise. After yet another solid US employment data, Eurodollar spreads continue to price in a full 75-bps rate rise at the November meeting of the Fed.

| 🔷 Wise Traders Best Choice - AssetsFX 🔷 |

Currently, a December rate rise is not discounted in Eurodollar spreads, but it is in Fed funds futures; this mismatch might ultimately favor more US Dollar gain.

The US Treasury yield curve remains inverted around -50 basis points, and the likelihood of a Fed rate rise is growing, which continues to support the US Dollar. US real interest rates (nominal rates minus inflation expectations) are reaching annual and multi-decade highs, bolstering the surge.

Resilient Fed rate rise expectations remain a source of organic support for the US Dollar, and troubles elsewhere, for the British Pound, the Euro, and the Japanese Yen, provide a significant cushion against pullbacks.

In terms of positioning, the CFTC's COT report for the week ending October 4 indicates that speculators boosted their net long US Dollar positions to 31,691 contracts from 30,609 contracts.

Hot Topics

India's Foreign Exchange Reserves Will Continue To Decline

What Does The Inverse Head And Shoulders Trading Pattern Mean?

The US Military Will Gain Access To A Crypto Threat To National Security

Given the US Dollar's advance after the conclusion of the reporting period, a more significant increase in net-long posture is predicted in the future. Overall, US Dollar positioning is around its net-longest levels in more than five years; the long US Dollar trade remains overloaded.