The inverse head and shoulders pattern, also known as a "head and shoulders bottom," is an exact replica of the classic head and shoulders pattern, but with the top of the pattern switched to predict reversals in downtrends.

This pattern is detected when a security's price falls to a trough, rises, falls below the prior trough, and then falls again, but not as far as the second trough. After the last dip, the price rises to the prior troughs' resistance.

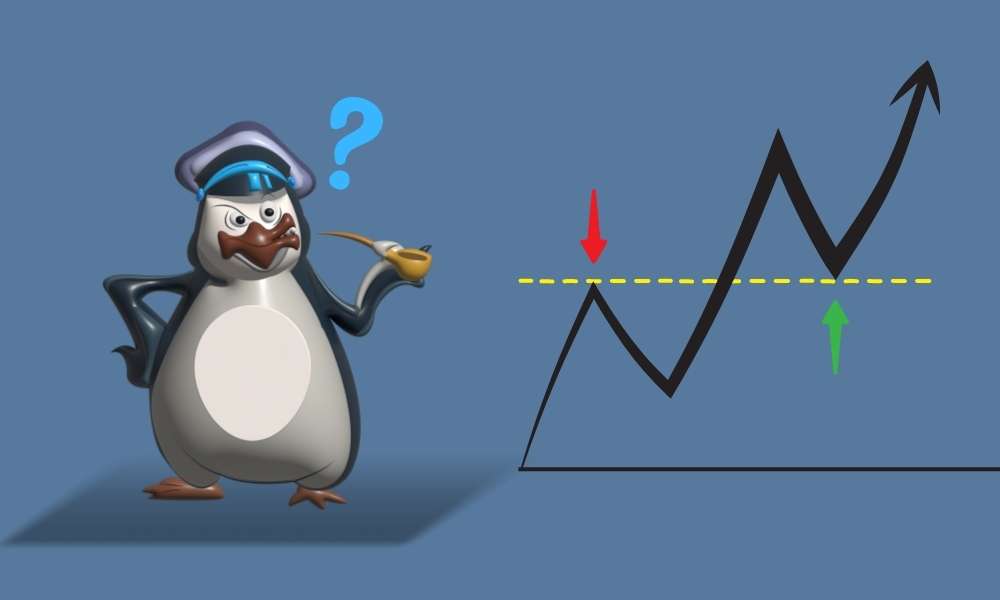

When price rises over the neckline, investors go long. First and third troughs are shoulders, second peak is head. Above the resistance, or neckline, signals a rapid surge higher. Traders look for a volume surge to confirm a breakout. This pattern is the inverse of the popular head and shoulders pattern and is used to indicate movements in a downturn.

Measuring the distance between the bottom of the head and the neckline of the pattern might help choose a good profit target.

| 🔷 Wise Traders Best Choice - AssetsFX 🔷 |

If the head-to-neckline distance is 10 points, the profit target is ten points above the neckline. Below the breakout price bar or candle, put a stop-loss order. Or, a stop-loss order might be placed below the right shoulder of the inverse head and shoulders pattern.

The opposite of an inverse head and shoulders chart is the regular head and shoulders, used to predict up-trend reversals. This pattern is detected when a security's price rises to a peak, falls, climbs above the old peak, then falls again. Finally, the price rises again, but not as far as the second peak. After the final peak, the price falls toward the prior peaks' resistance.

The head and shoulders pattern's ups and downs tell a story about bulls and bears.

Initial decline and peak show negative trend momentum towards first shoulder. Bears want to push the price below the shoulder's initial trough to hit a new low (the head). Bears might regain market supremacy and prolong the downtrend.

Once the price rises again and surpasses the previous peak, bulls gain ground. Bears try again to push the price lower but only touch the original lower. This inability to surpass the lowest low marks the bears' loss, and bulls drive the price upward, completing the reversal.

Inverse head and shoulders pattern creation is reliable confirmation of trend reversal. When the asset rallies to the point where the right shoulder breaks the neckline, the pattern is considered to have been completed. As a result of the bulls' recent dominance in the market and the subsequent establishment of an upward trend, traders opt to take long positions.

It is a precise pattern that makes it possible for traders to properly arrange an entrance exactly above the neckline of the formation and to put stop-loss orders below the right shoulder.

To be able to take a position, however, one needs to be quick enough to see the pattern. Although a decline in price during an uptrend is very normal and gives traders a second opportunity to purchase, it is not a given that this will occur.